The city has long appealed to landlords looking for a safe buy-to-let property investment, particularly in recent years, on the back of rising rental returns, as rental values go from strength to strength.

Despite Britain's weak economic outlook and growing European woes, rental prices in London have been increasing due a surge in demand from tenants. This has been mainly driven by the fact that many would-be purchasers have had difficulties in raising the necessary mortgages required to buy a home.

"There are grounds for optimism because despite the bleak [economic] picture, many people have been excluded from buying, so there is an increase for rental," said Yolande Barnes of Savills. "The lack of supply has put pressure on rentals so yields are expected to increase."

With the 2012 Olympic Games drawing closer, demand for rental properties in London will almost certainly increase further next year; an attractive proposition for active property investors.

Many landlords are asking huge rental prices during next summer's Olympics. In some cases, asking rents are reportedly already rocketing to six times the normal value. London-based estate agents Foxtons is one that is advertising Olympic lets at record-breaking prices, including a penthouse in Knightsbridge that is being advertised at £100,000 a week as an Olympics let.

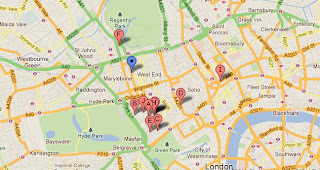

Property expert Jane Marr of J Marr Group said that searchers for property for sale in London will be as popular as ever next year as London is considered a "safe haven" for property investment. This is particularly the case at the high end of the market, including houses for sale in St Johns Wood as well as flats for sale in St Johns Wood, Chelsea and Mayfair, among other primary locations.

"Compared to other European cities, London is very attractive and demand for luxury homes is still rising. We asked if the rich were getting richer in a recession and from here it certainly looks that way," she explained.

In the prime London property market, the interest is mainly from overseas nationals, especially those from China, Russia and Europe. This has certainly been the case as far as demand for flats for sale in Primrose Hill is concerned.

Andrew Ellinas of Sandfords commented: "Overseas buyers are particularly keen to invest in the Capital especially since the Eurozone crises, with many properties sold going to cash-rich Europeans looking to move some of their wealth into the stability of the prime London property market."

Flats for sale in Little Venice have also attracted a high level of interest from international purchasers, with some homes being sold for sealed bids of in excess of asking prices.

Christian Harper of estate agency Oliver Finn told the press: "I believe the dramatic increase in prices has been fuelled by both a shortage in available stock and foreign investment. We are back to sealed bids and high levels of activity due to a worrying shortage of new instructions."