The Savills Prime Central London Index showed average price growth of 87 per cent in the six years to mid-2011, with the highest capital growth recorded in Mayfair, to the delight of Mayfair estate agents.

Savills report that Mayfair outperformed the rest of the capital on price growth, up 117 per cent on average in six years,

Residential property prices in London have demonstrated a distinct spatial pattern over time, rising initially in a cyclical upswing in prime central London before spreading out to secondary locations.

Despite the recent lull in the UK property market, Savills claim that there has been a recovery in the market in many parts of London, with mainstream prices having increased by 25 per cent, on average, in the past six years.

Property consultants Knight Frank have identified a number of hotspots in London, including many secondary areas, which are expected to boom in the next few years.

The company expects prices to increase by an average of 30 per cent in prime areas by the end of 2015 but with some neighbourhoods seeing far greater gains.

Grainne Gilmore, head of UK residential research at Knight Frank, said: "The prime London property market is buoyant, but there are pockets of London where the opportunity for development, and other factors such as improved transport infrastructure, gentrification or regeneration, combine to produce real opportunities for housebuilders and ultimately for those in need of housing."

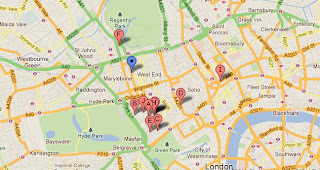

Many Paddington estate agents are bracing themselves for potential growth in demand for Paddington properties to both buy and rent, after it was outlined as an up-and-coming corporate hub.

Richard Kauntze, Chief Executive for the British Council for Offices, highlighted Paddington as one of a select few areas outside the main London business districts which is growing in popularity.

He said that attitudes towards Paddington, previously perceived as being "fringey", had "really changed with the Paddington Basin development," he commented.

"Some significant business office occupiers have moved in [to Paddington] and it is an area that is very close to the centre of London," Mr Kauntze added.

Rising demand for office space in Paddington is contributing towards the gentrification of the area and making it a more popular place to live.

"The capital continues to soar away and outperform the wider UK property market and is seen as the world's safest haven for bricks and mortar," said Andrew Ellinas of Sandfords.

He continued: "An acute stock shortage and unprecedented buyer demand in prime areas such as Regent’s Park and Marylebone is helping to underpin prices by as much as 10 per cent in the last 12 months."

But while many buyers compete to take advantage of excellent rental returns yields and the prospect for strong capital growth in areas like Marylebone and Regent's Park, some property experts believe that greater returns could be achieved in nearby areas that potentially offer greater room for growth.

Lisson Grove estate agents have long claimed that properties in Lisson Grove are cheap, in comparison to nearby areas, which also includes St John's Wood and Baker Street.

But whether more shrewd property investors will look beyond prime central London and invest in secondary locations is another matter. Only time will tell.